The Art of Company Valuation - Complete course

29

March

2024

The Art of Company Valuation - Complete course

.MP4, AVC, 1280x720, 30 fps | English, AAC, 2 Ch | 6h 43m | 5.76 GB

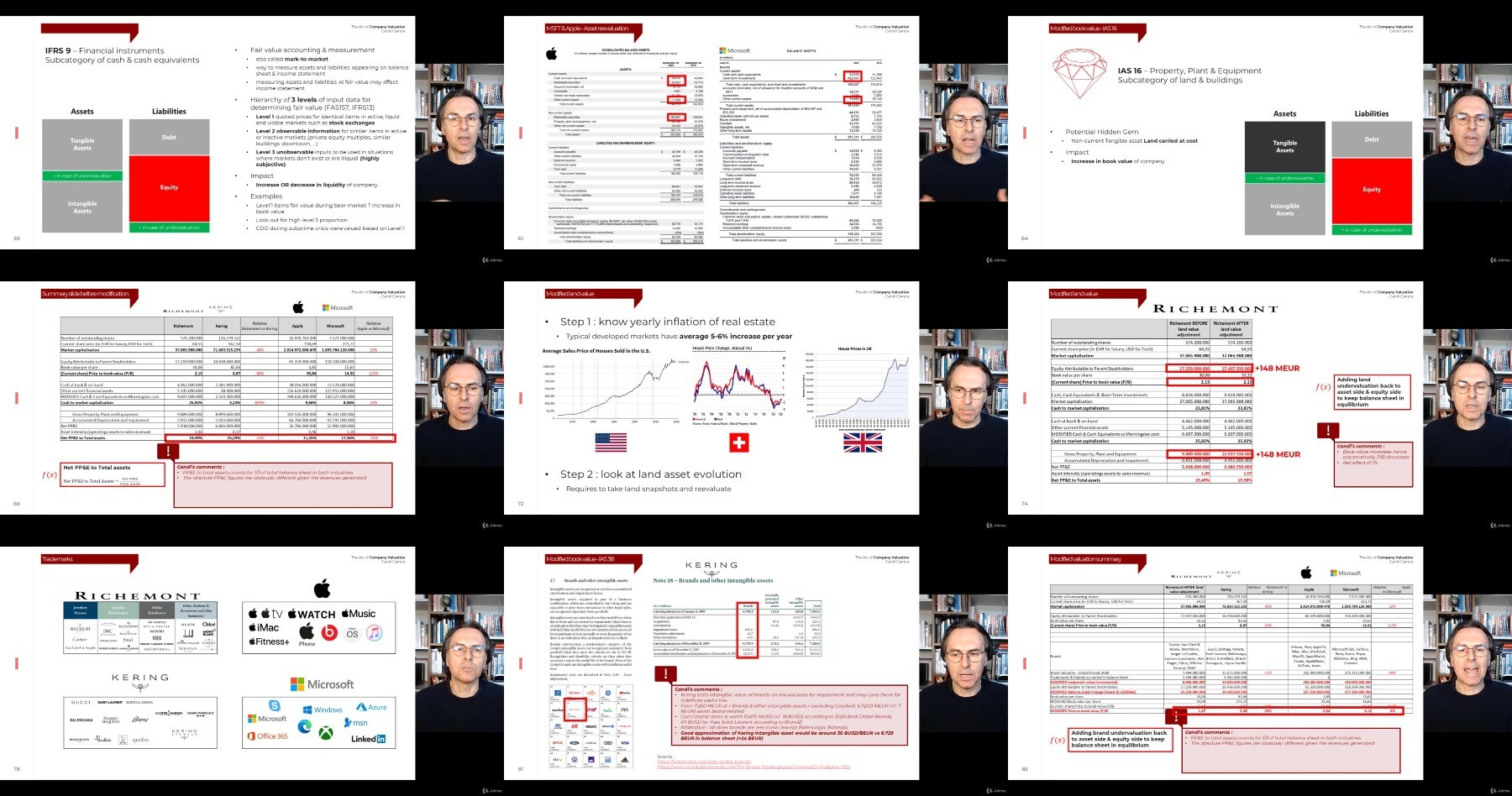

Instructor: Candi Carrera

Advanced Masterclass for Investors

What you'll learn

Be able to determine the intrinsic / real value of a company using cash flow to the firm & equity methods

Be able to apply the right valuation method depending if you are into startup investing, private equity or public equity investment universe

Understand the main company valuation methods (asset based valuation methods, going concern valuation methods, relative valuation methods)

Understand the difference between absolute & relative valuation methods

Become fluent in executing a discounted cash flow / future earnings valuation

Be able to adjust balance sheet items in order to modify the book value of a company

Requirements

Have an average understanding of financial statements

Be able to differentiate between balance sheet, income statement & cash flow statement

Be able to understand how to calculate a net present value or discounted value

Be able to read financial statements like 10Q & 10K reports

Description

Knowing what an asset is worth is a prerequisite for intelligent decision making. As an investor I always want to know what the intrinsic value is vs current share price or the price the seller is offering (if private equity) and if I have a safety margin on the price.

After this course you will be autonomous in evaluating companies. You will be equipped with a set of methods and knowing how to apply those methods in the public equity, private equity or venture capital universe :

asset-based valuation (cash to market cap, book value, modified book value, liquidation value)

going concern valuation (multiple revenue/earnings method, Free Cash Flow to Firm including DCF & DFE, Free Cash Flow to Equity including DDM, Gordon & Total shareholder yield)

relative valuation to understand the financial strength of a company (P/B, P/CF, P/S, P/E, PEG, EV)

Investing requires practice. In this training we will practice all absolute & relative valuation methods with 4 companies being 2 luxury companies (Richemont & Kering) & 2 tech companies (Apple & Microsoft). We will apply all our learnings each time for those 4 companies instead of using dummy companies that do not exist. The course will also cover special valuation situations like VC investments, IPOs/DPOs and banks. In those special valuation situations, we will be practicing on companies like Fitbit, GoPro, Etsy for the IPO/DPO part and Bank of America & Wells Fargo for bank valuation part.

After this course you will be able to determine the real value of a company vs the current share price. If you want to become a fully independent investor with deep valuation methods, this course is for you. BE AWARE this course is an ADVANCED LEVEL course.

Investing in stocks and acting as a business-owner can be a life-changing experience. Learn from my 20 years experience as an investor running my own investment fund and rapidly move ahead faster with the knowledge I will share with you.

Many thanks and I appreciate your interest in my course!

- Candi Carrera

Who this course is for:

Investors wanting to develop in-depth knowledge on company valuation and applying those methods to VC, PE and public equity companies

Investors wanting to learn how to calculate cost of capital and cost of equity

Junior company appraisers

More Info

https://rapidgator.net/file/22da31390b36c946e664edc7c32d9660/_The_Art_of_Company_Valuation_-_Complete_course_2021-3.z01

https://rapidgator.net/file/6c78848d36e42cf2af881dbe0bd35d52/_The_Art_of_Company_Valuation_-_Complete_course_2021-3.z02

https://rapidgator.net/file/b769768001324ac6db7191fb6e633ebc/_The_Art_of_Company_Valuation_-_Complete_course_2021-3.zip

https://voltupload.com/94y6gzf5safw/_The_Art_of_Company_Valuation_-_Complete_course_2021-3.z01

https://voltupload.com/62l6sq984zqf/_The_Art_of_Company_Valuation_-_Complete_course_2021-3.z02

https://voltupload.com/yaho3lplbi0a/_The_Art_of_Company_Valuation_-_Complete_course_2021-3.zip

Free search engine download: Udemy - The Art of Company Valuation - Complete course 2021-3

Note:

Only Registed user can add comment, view hidden links and more, please register now

Only Registed user can add comment, view hidden links and more, please register now